American Continental Insurance Company (ACI) is a leader in the Medicare Supplement market. ACI is headquartered in Brentwood, Tennessee. Founded in 2005, ACI became a Genworth Financial company in 2006 and was acquired by Aetna in 2012.

ACI is a subsidiary of one of the nation’s longest established insurance companies – Aetna. Aetna has been operating for over 100 years and during this time they have amassed a formidable reputation as one of the few insurers who genuinely care about their clients.

American Continental maintains an A rating with A.M.s Best. Their rating is a reflection of their financial history and their outstanding customer care. Their customer service is second to none, and their US-based call center staff are always reachable by phone during extended business hours and can boast about some of the lowest call handling times in the industry.

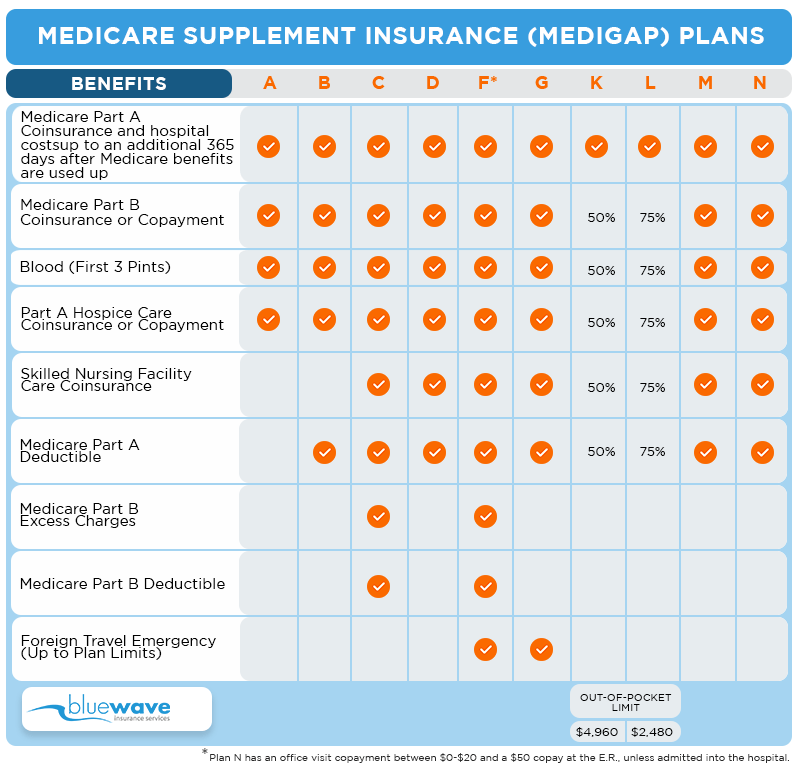

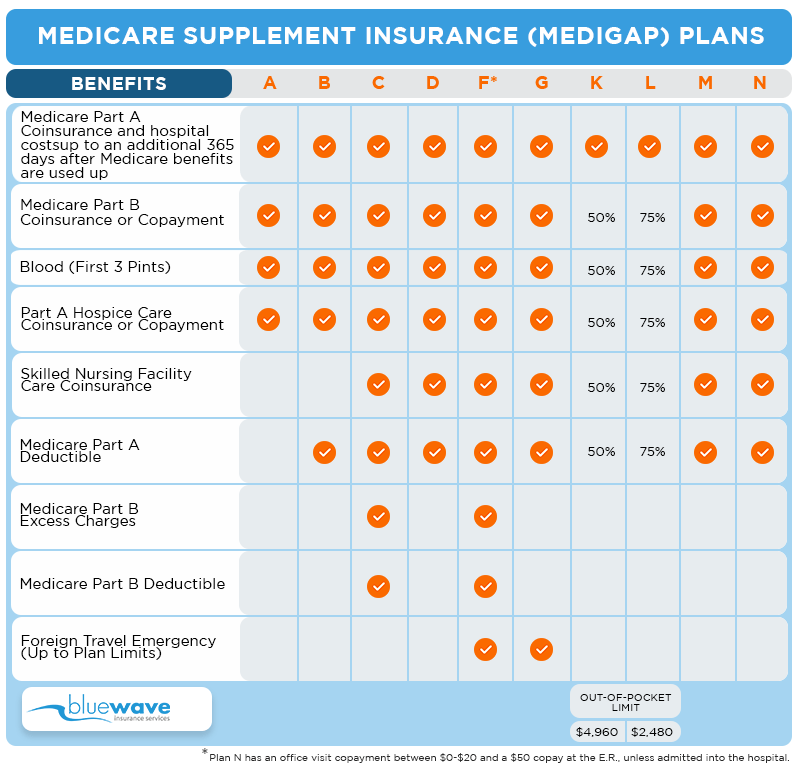

All Medicare supplement plans are standardized in accordance with federal law. This means that for whatever Medicare plan you choose, you will be getting the exact same coverage – regardless of the insurance provider, you decide upon.

With American Continental Medicare supplement you’ll get:

Yes! With American Continental you are free to choose any doctor that accepts Medicare. There is no network limitation, so you have the freedom to go directly to the doctor you are comfortable with.

Do you have to renew you American Continental Medigap plan?No, with American Continental Medicare supplement plans, you have guaranteed renewal year after year. You don’t have to worry about reapplying, it will automatically renew, as long as you pay the monthly premiums.

This is the most comprehensive plan out of all of the Medicare plans available from any insurer. Plan F covers 100% of all costs that Original Medicare does not cover.

With Plan F you get all the basic benefits which are Part A hospital coinsurance, an extra 365 days of inpatient hospital care after Original Medicare runs out, and also Part A and Part B blood coverage.

Here are some highlights of why folks choose Plan F:

Plan F offers the most coverage out of all the Medicare supplement plans. However, other plans may save you money on monthly premiums if you don’t need a lot of health care needs.

Plan G Offers the most value and is currently the most popular plan. You can read why here. The only difference between F and G is the Part B deductible of $240 for the year.

Here are some highlights of Medicare supplement Plan G:

Agent Tip

Even though Plan F and Plan G are almost identical, the benefit of Plan G is that it has lower monthly premiums, saving you money in the long-run while at the same time giving you robust coverage.

Plan N is like plan G except Part B excess charges are not covered, and there is a copay of up to $20 at a doctor and $50 at the E.R. (waived if admitted).

Although Plan N is limited it still gives coverage for:

Plan N is the most affordable plan out of all the Medicare supplement options. Even though it may not cover everything, it can be the perfect plan for individuals that don’t need a lot of medical care but would like to cover the “gaps” in Original Medicare.

American Continental (Aetna) is one of the best insurers for your Medicare Supplement Insurance. They have proven to have some of the best rate stability with rate decreases across the country on their Plan G.

Backed and serviced by Aetna, you never have to worry about spending a long time on hold or getting subpar customer service.

thumb

We recommend American Continental to our clients for their Medicare Supplement plan. For free assistance call us direct at (800) 208-4974.